Strategic Asset Allocation

We found that tactical funds generally struggled to deliver competitive risk-adjusted returns when compared with a traditional balanced fund. With a few exceptions, they gained less, were more volatile, or were subject to just as much downside risk as a 60 percent-40 percent mix of U.S. stocks and bonds.

Source: Morningstar Research of Tactical Asset Allocation Funds, 2012

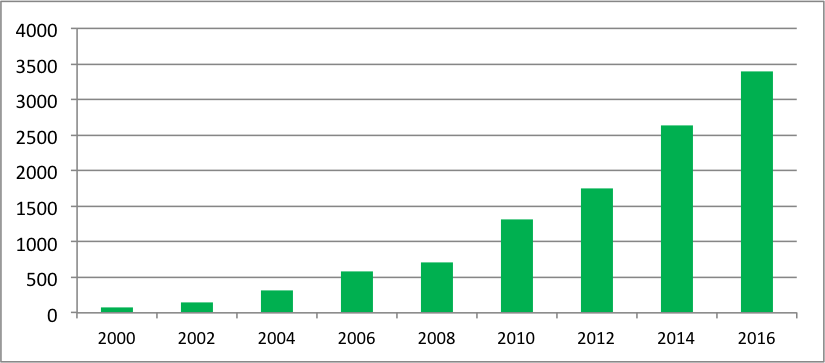

ETF

Total Global ETF assets (in $bn)

Source: ETFGI.com

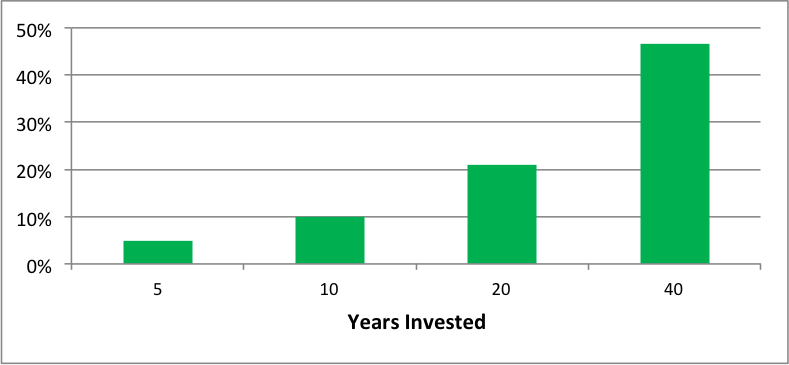

Low-Fee Advantage

Increase in investment value by eliminating a 1% asset fee