INVESTMENT LESSONS

Lesson 1 – Compounding

If you’re in your 20s, 30s or 40s, you should be investing with a long-term plan. This is a strange concept in our modern world where we are becoming more and more focused on the short-term – on instant results.

But this long-term focus is critical. Not only because we are living longer so need to save for longer to fund our longer retirement years. But also because we need time to get the amazing benefit of compounding returns.

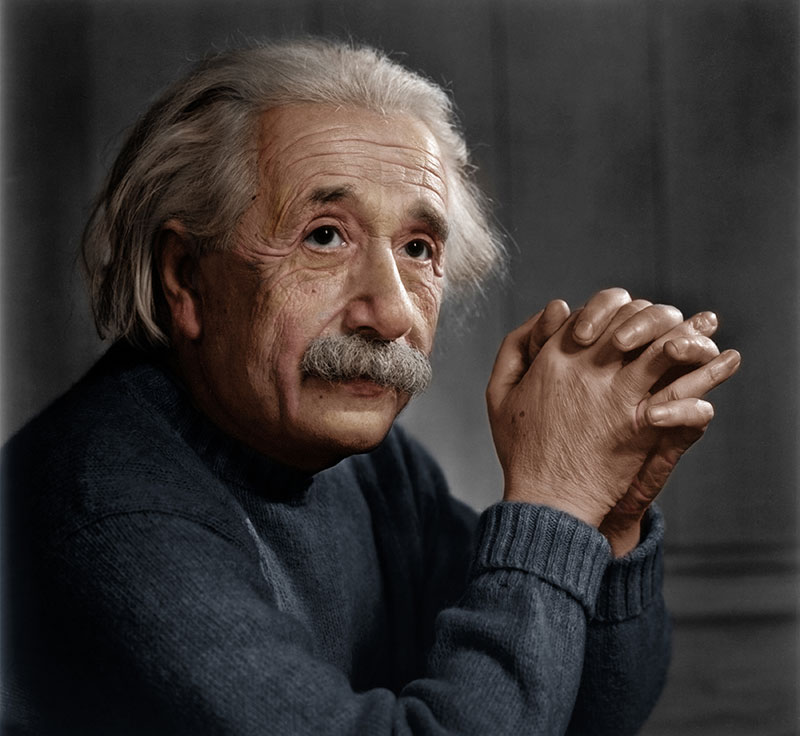

Compounding of returns is truly amazing. Albert Einstein referred to it as the “eighth wonder of the world’’ and yet this ‘wonder’ is accessible to all of us. All we need is patience because it starts slow – at tortoise pace – but with time it gathers momentum as you get returns on returns on returns…

Consider this simple example, three friends aged 25, each invest R500 a month for a ten-year period and then leave the accumulated money invested until age 65. Let’s assume they get a 9% annual return on their investment – this is the rate we as South Africans can currently get on long term South African bond investments.

- Eric, the early starter, saves from age 25 to 35

- David, the delayed starter, saves from age 35 to 45

- Larry, the late starter, saves from age 45 to 55

Each invests exactly the same amount, R60,000 – R500 a month for ten years. The only difference is the timing and how long the contributions are invested.

I think we all agree that Eric will have the most money at 65, but how much more money will he have compared to the others? The results will surprise most of you.

In round numbers, Eric would have about R1.2m, David would have about R520,000 and Larry would have about R220,000. Eric’s investment value would be more than double David’s and nearly six times Larry’s. Wow, that’s a massive difference in value for the same contributions made. All from the power of compounding returns.

So lesson 1: Start saving early and click here to stay invested through Triarc for as long as possible.

Coming soon……Lesson 2 – Taxes and Costs

Author: David Shochot, CEO Stylo Investments

Published on triarc.co.za